| Investor |

PE Assets $mlns |

Portfolio |

M&A Activity Buy vs Sell, Last 5 Years |

|

|---|---|---|---|---|

| Total | Current | |||

|

FSN Capital

Oslo, Norway |

4,508 | 62 | 30 |

|

New York, New York, United States |

267,000 | 499 | 253 |

|

|

H.I.G. Private Equity

Miami, Florida, United States |

65,000 | 398 | 174 |

|

|

Stone Point Capital

Greenwich, Connecticut, United States |

55,000 | 122 | 49 |

|

|

Warburg Pincus

New York, New York, United States |

83,000 | 510 | 176 |

|

|

Advent International

Boston, Massachusetts, United States |

76,000 | 412 | 105 |

|

|

Stellex Capital Management

New York, New York, United States |

2,600 | 35 | 29 |

|

|

TA Associates

Boston, Massachusetts, United States |

65,000 | 458 | 119 |

|

|

Mill Point Capital

New York, New York, United States |

1,400 | 30 | 21 |

|

|

TorQuest

Toronto, Ontario, Canada |

2,280 | 46 | 18 |

|

|

STG

Menlo Park, California, United States |

10,000 | 67 | 29 |

|

|

Latticework Capital Management

Dallas, Texas, United States |

550 | 12 | 10 |

|

|

Aavin Equity Advisors

Cedar Rapids, Iowa, United States |

275 | 48 | 21 |

|

|

Azalea Capital

Greenville, South Carolina, United States |

- | 25 | 8 |

|

|

Synova

London, United Kingdom |

2,617 | 37 | 16 |

|

|

PSG

Boston, Massachusetts, United States |

14,000 | 129 | 114 |

|

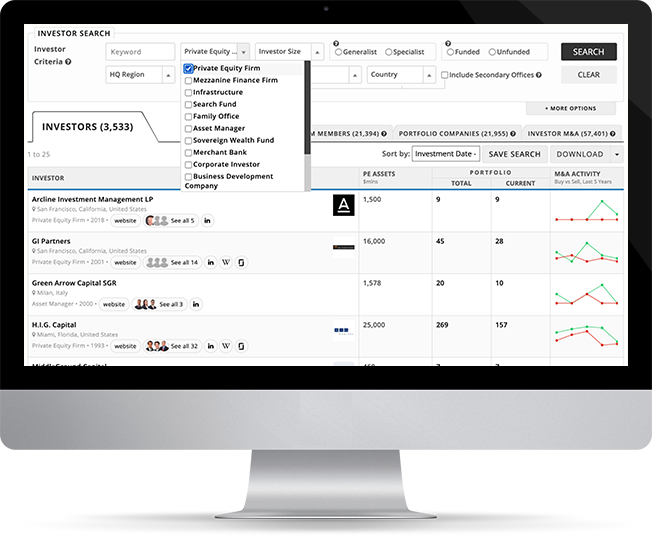

Mergr was built to make it easier to research private equity firms, their investments, and who they buy from and sell to.

Behind each firm is a strategy, and Mergr gives professionals structured access to firm profiles, portfolio companies, and investment history across the private equity landscape.

The platform is powerful but easy to use — so you can quickly identify the right firms and focus on qualified opportunities.

Full access to Mergr's investor, acquirer, and transaction data starts here.