| Name | M&A Clients |

Deal Count Last 5 Yrs - Total |

Deal Count Last 5 Yrs - YoY |

|

|---|---|---|---|---|

| Investor | Corporate | |||

|

Chicago, Illinois, United States |

244 | 775 | 1008 |

|

|

Los Angeles, California, United States |

124 | 514 | 475 |

|

|

Boston, Massachusetts, United States |

96 | 220 | 306 |

|

|

Boston, Massachusetts, United States |

68 | 333 | 286 |

|

|

Chicago, Illinois, United States |

84 | 328 | 271 |

|

|

New York, New York, United States |

50 | 209 | 216 |

|

|

Los Angeles, California, United States |

54 | 239 | 214 |

|

|

Chicago, Illinois, United States |

78 | 137 | 213 |

|

|

New York, New York, United States |

61 | 173 | 194 |

|

|

New York, New York, United States |

51 | 214 | 193 |

|

|

Chicago, Illinois, United States |

58 | 220 | 189 |

|

|

New York, New York, United States |

30 | 417 | 189 |

|

|

New York, New York, United States |

75 | 204 | 183 |

|

|

New York, New York, United States |

29 | 200 | 168 |

|

|

Palo Alto, California, United States |

13 | 278 | 161 |

|

|

Washington, District of Columbia, United States |

47 | 259 | 161 |

|

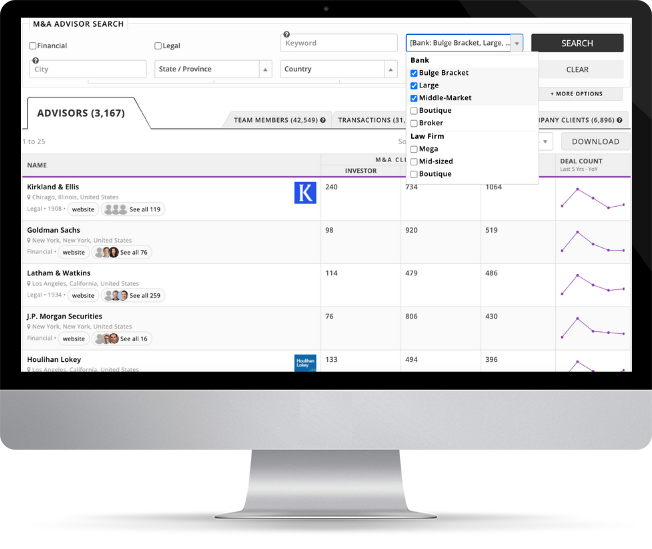

Mergr was built to help professionals track the advisors, bankers, and firms behind buy- and sell-side M&A activity.

Every deal involves decision-makers, and Mergr gives you access to advisory firm profiles, past transaction roles, and deal history — all in one place.

The platform is powerful but easy to use — so you can identify the right advisors for your next opportunity.

Full access to Mergr's investor, acquirer, and transaction data starts here.