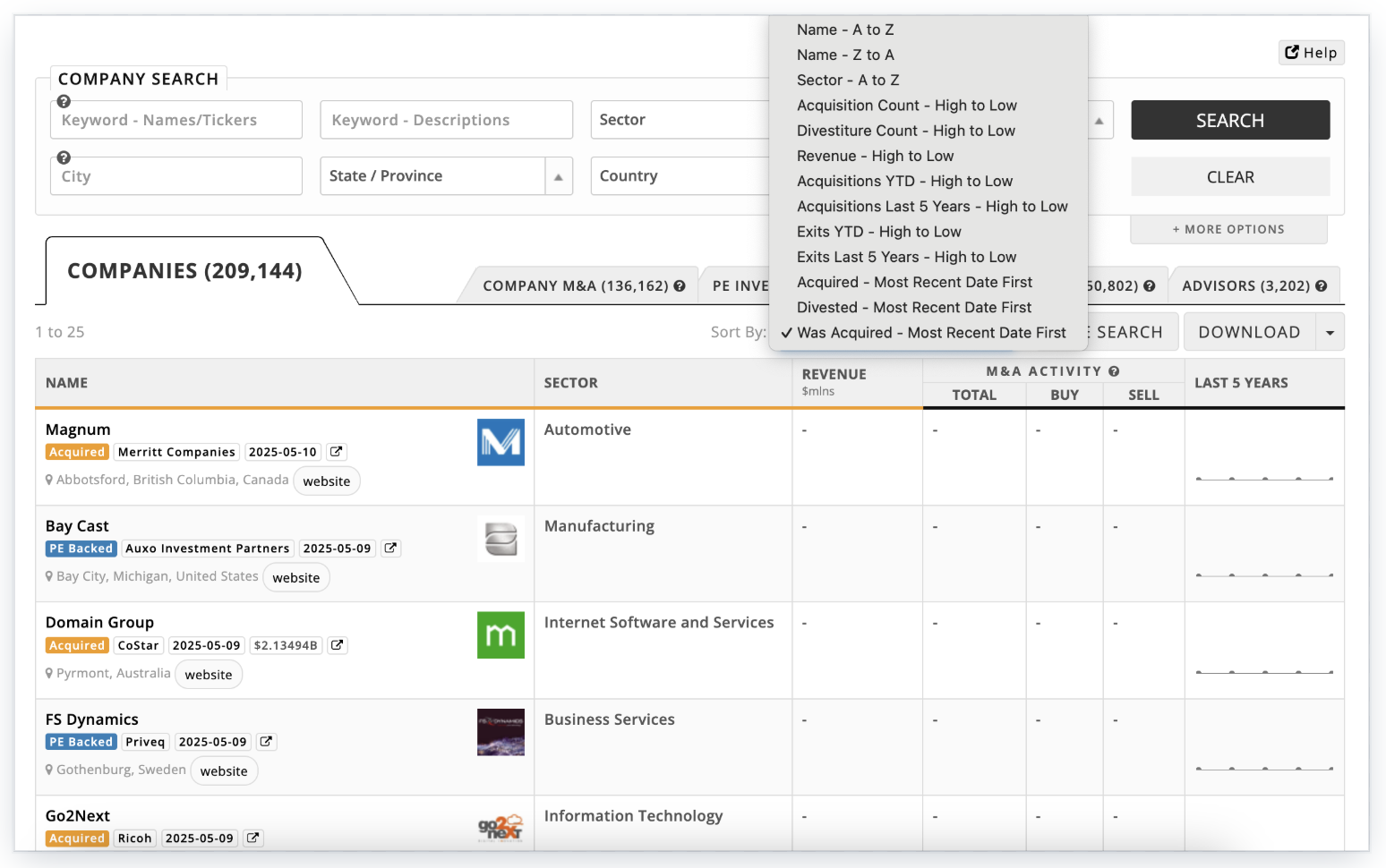

Find Companies Going Through M&A (Trigger Events)

Companies involved in an acquisition or private equity deal often need new vendors and advisors. Whether in need of a new IT system, employee benefits, or help with audit or tax compliance, Mergr helps you identify recently acquired companies so you can approach them with relevant, time-appropriate solutions.

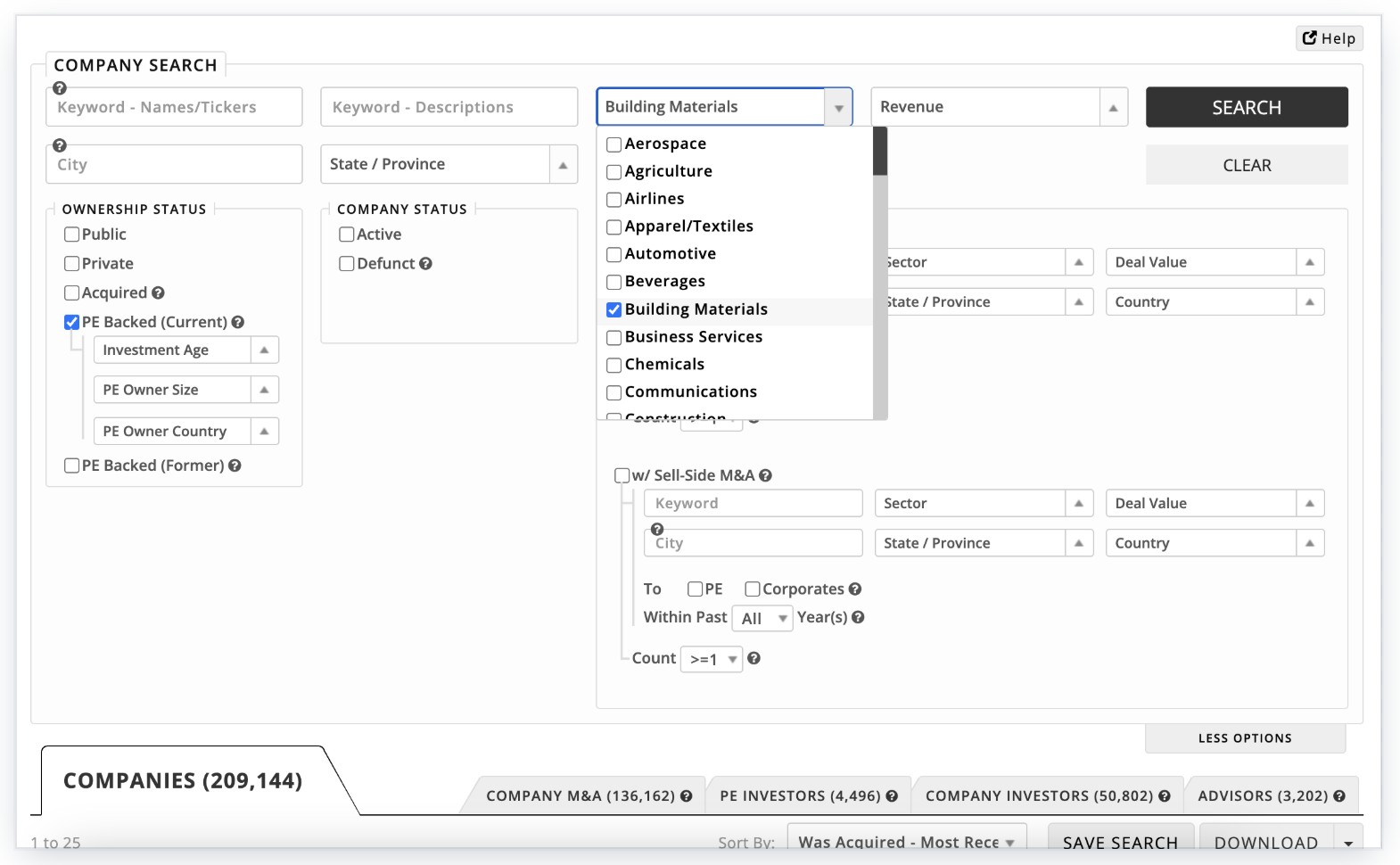

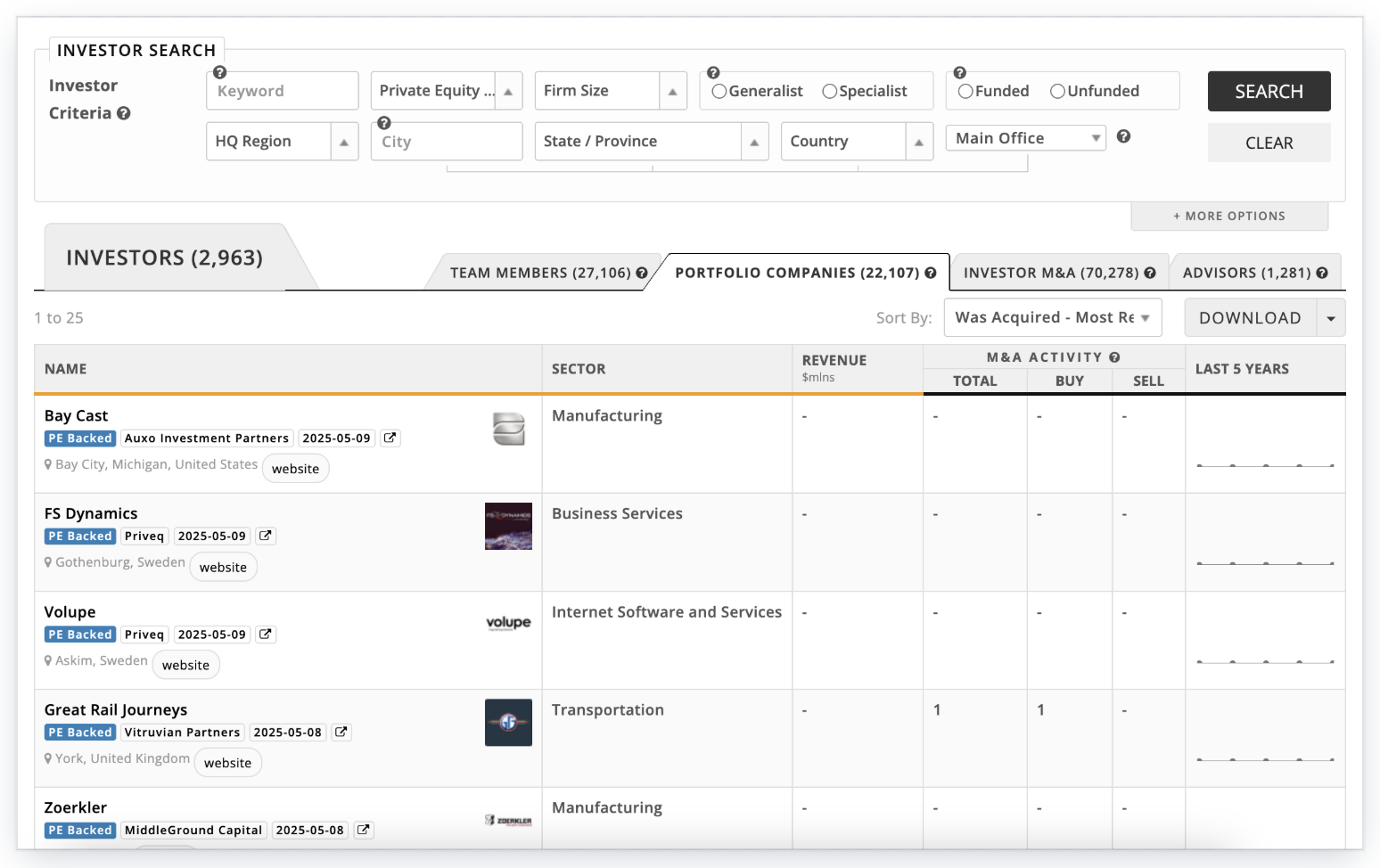

Target PE Backed Companies

PE-owned companies often have aggressive growth and modernization plans - with budgets for professionalization, systems upgrades, compliance, or add-on acquisitions.

Build Account-Based Prospect Lists

Mergr allows you to build highly-targeted company or investor lists by industry, size, geography, ownership type (PE backed, public, private). Find new clients that match your ideal customer profile.